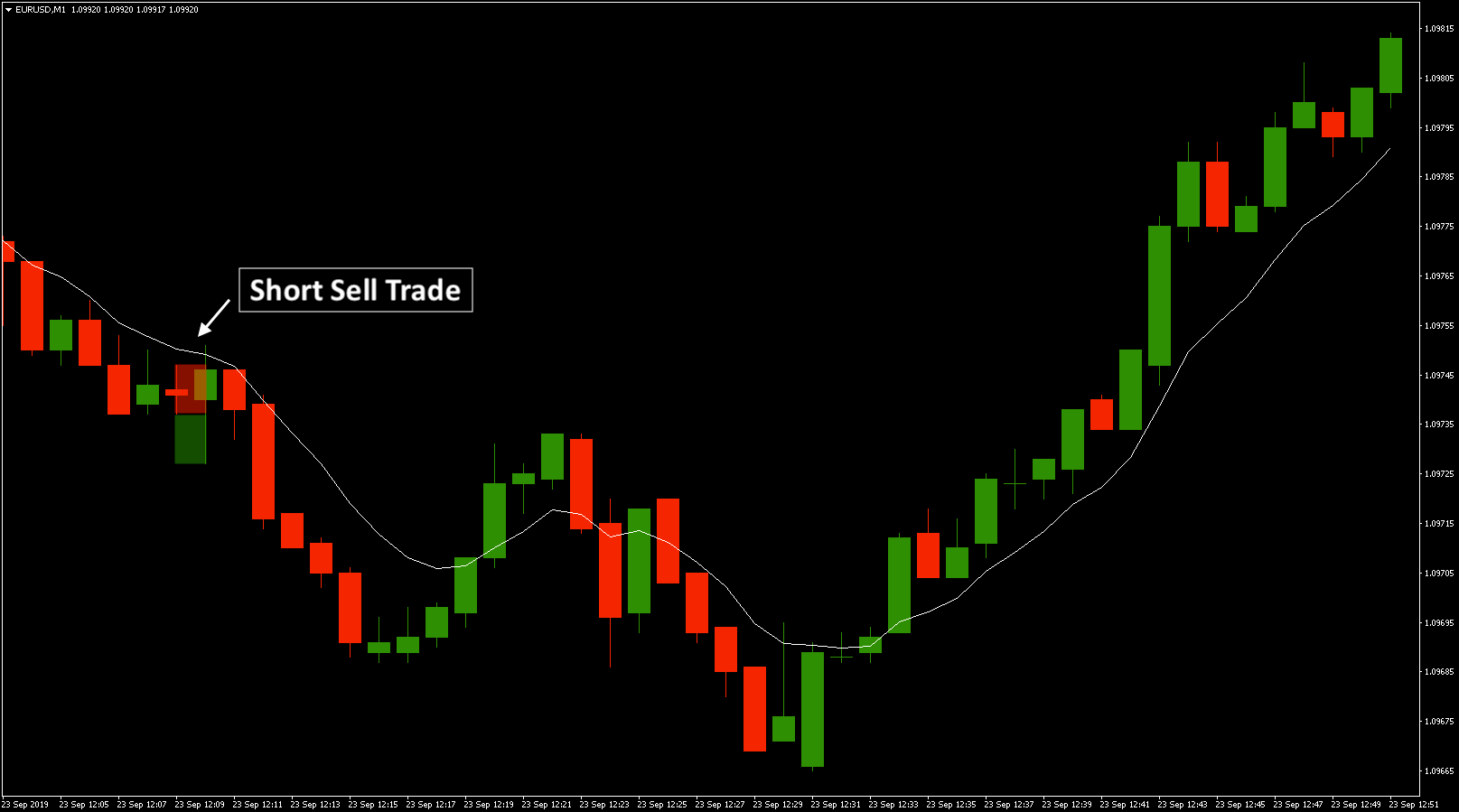

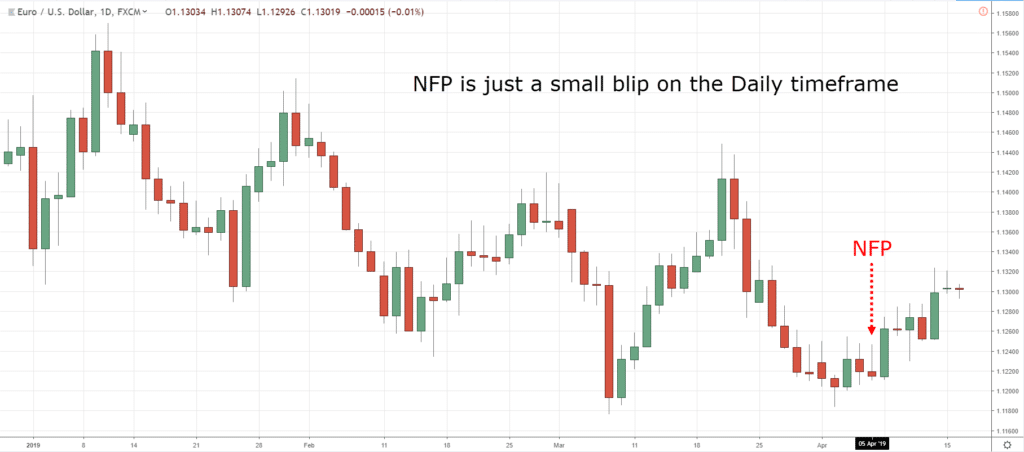

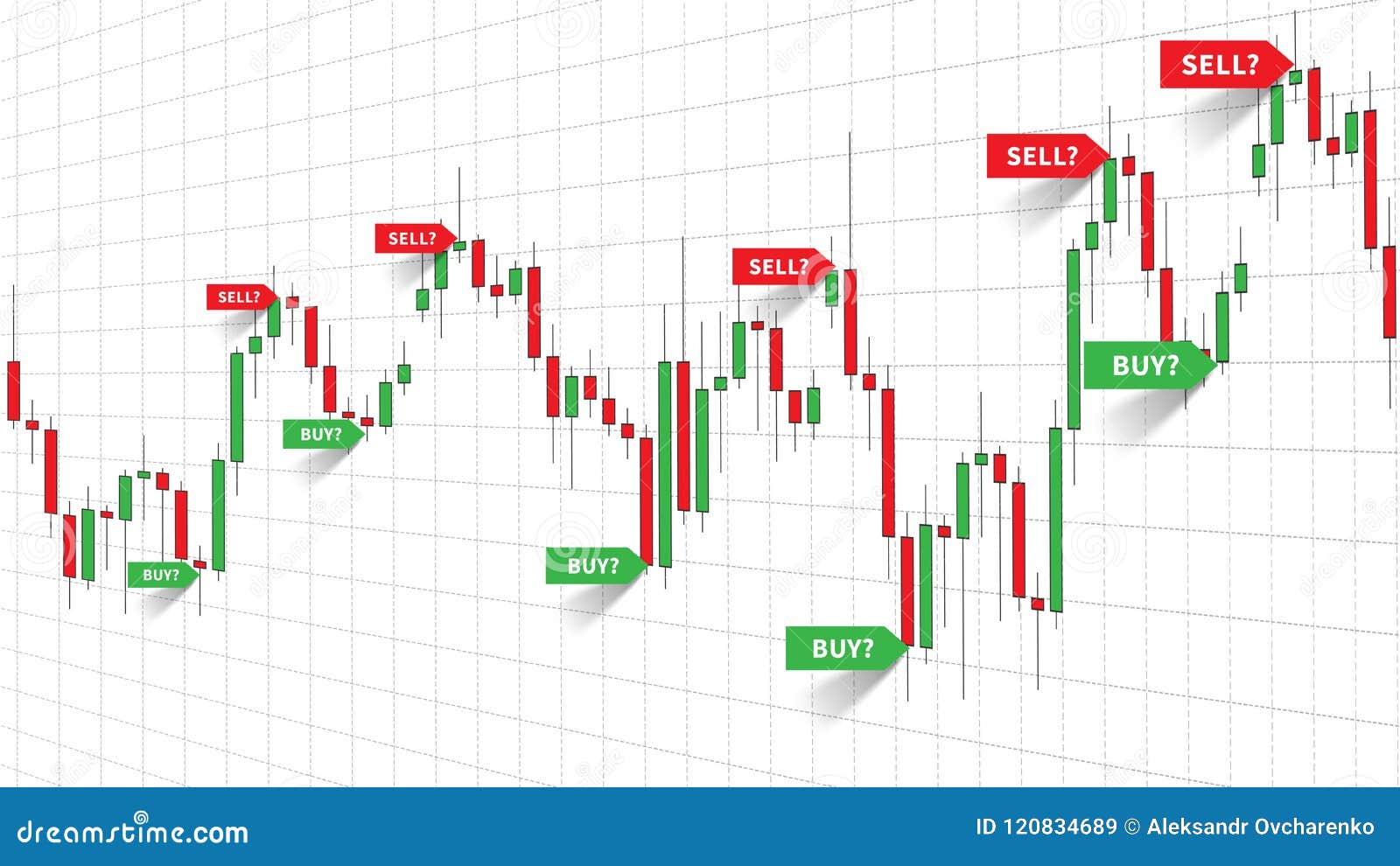

Bro / sist kali aja ada yang punya buku When to BUY and SELL Candlestick can TELL karangan santo vibby, saya mau beli donkasal harganya wajarAs can be inferred from a large bearish candlestick, the bears were confident in selling at the area of the open of the large bearish candlestick; It seems intimidating at first, but a simple trading indicator can help us out here – the moving average A straightforward yet powerful trading strategy is to analyze candlestick patterns using a moving average While candlestick patterns focus on the shortterm buy/sell balance, the moving average offers the bigger picture or the trend context

Reading And Using Your Candlestick Chart To Make Decisions About Stocks Dummies

When to buy and sell candlestick can tell pdf

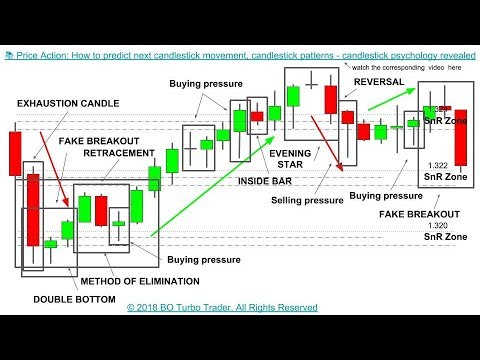

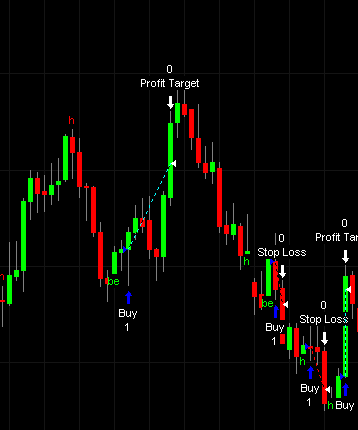

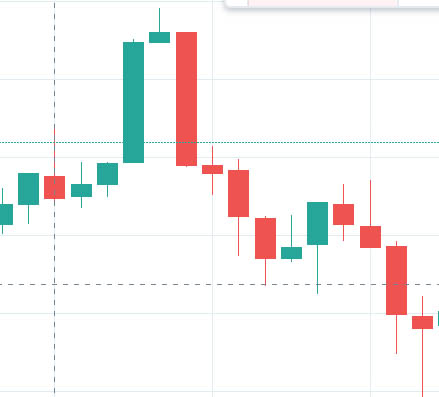

When to buy and sell candlestick can tell pdf- In figure 2, we can see a large bearish candlestick has engulfed the previous, smaller, bullish candlestick By definition, it is a Bearish Outside Bar (BEOB) If you have placed a sell stop order few pips below the low of the BEOB candlestick and targeted the next pivot zone, it would have turned out to be a winning trade with a decent rewardIn addition, the bulls were unable or unwilling to buy and thus the bears were able to sell without much opposition throughout the entire trading day

Forex Candlesticks A Complete Guide For Forex Traders

Buy and Sell on eToro now CFD trading All trading involves risk Only risk capital you're prepared to lose The information above is not investment advice views eToro is the world's leading social trading platform, offering a wide array of tools to invest in the capital markets Create a portfolio with cryptocurrencies, stocks We can tell that in late November 19, the price plummeted down from $5621 to $4703 but we want to know how it happened– which this chart does not tell us If we look at the same company with a candlestick chart , we can gain more valuable insight on what happenedA candlestick chart example dt_gap height="10″ / Candlestick Chart Overview In any transaction, be it buying a car, booking a holiday or investing in property, there needs to be a seller selling a product or service at a designated price and a buyer willing to pay it

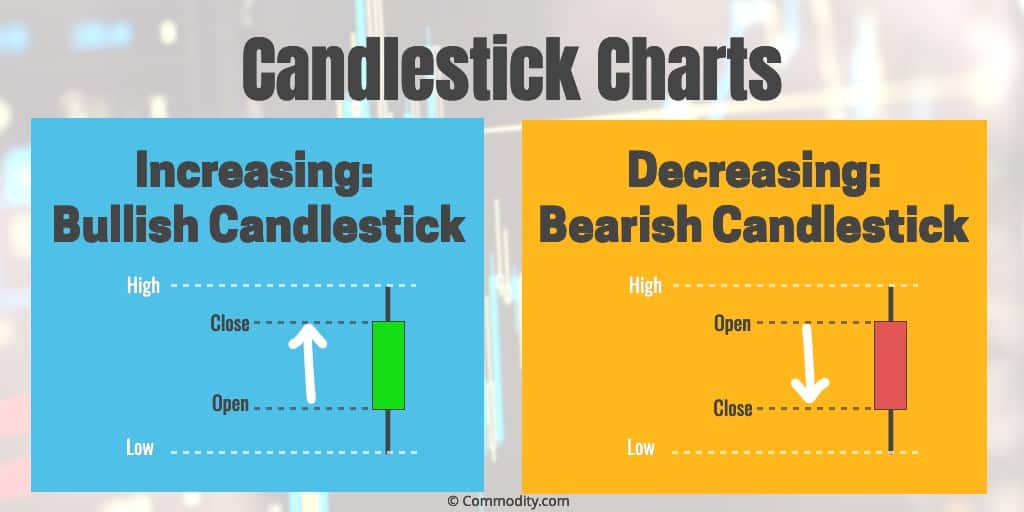

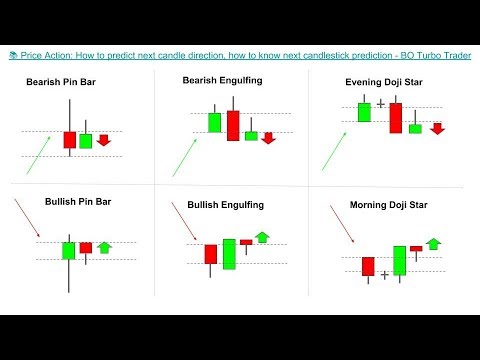

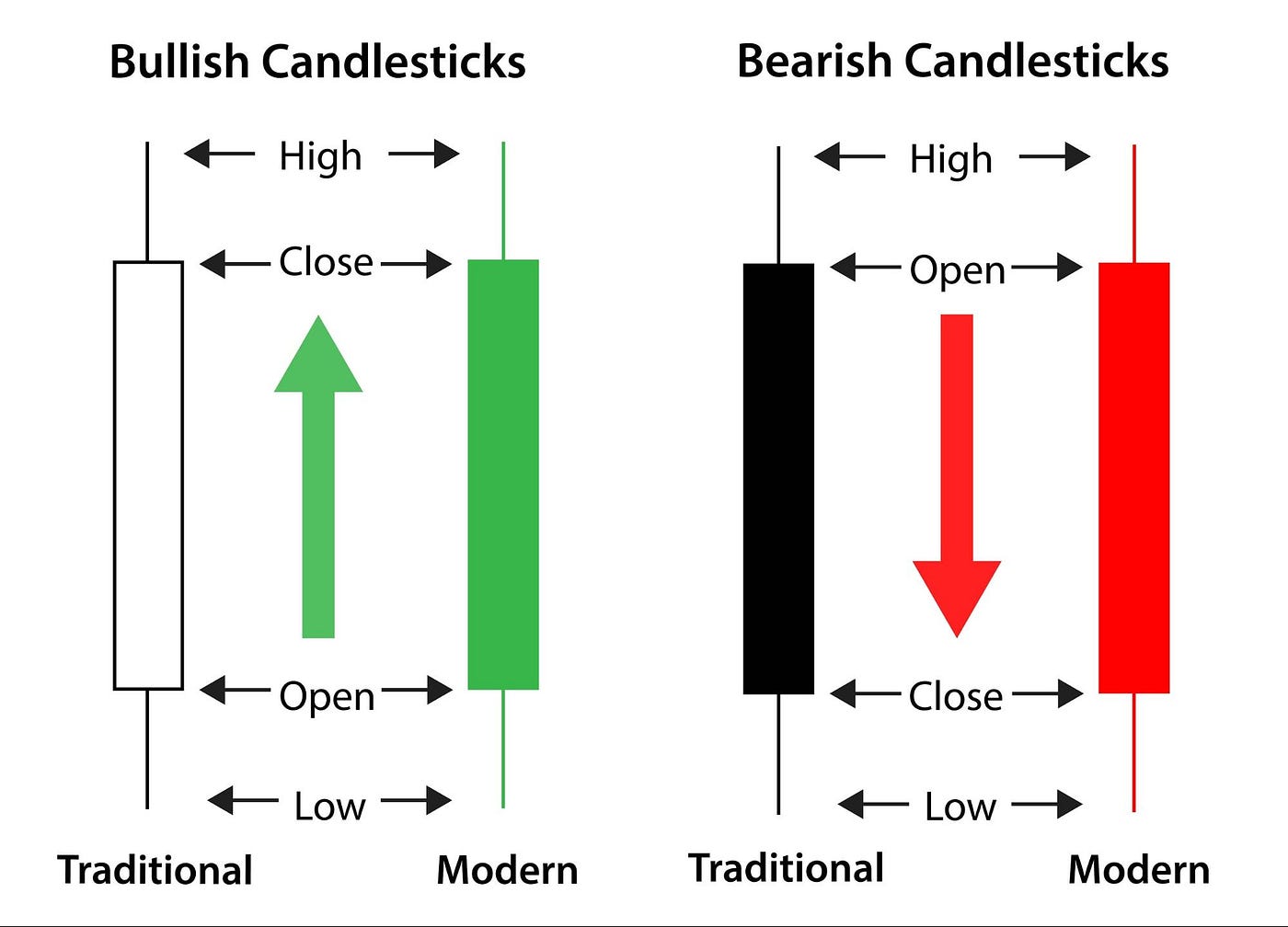

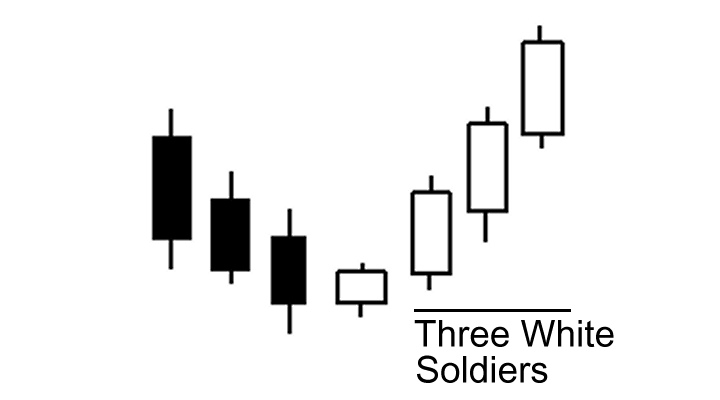

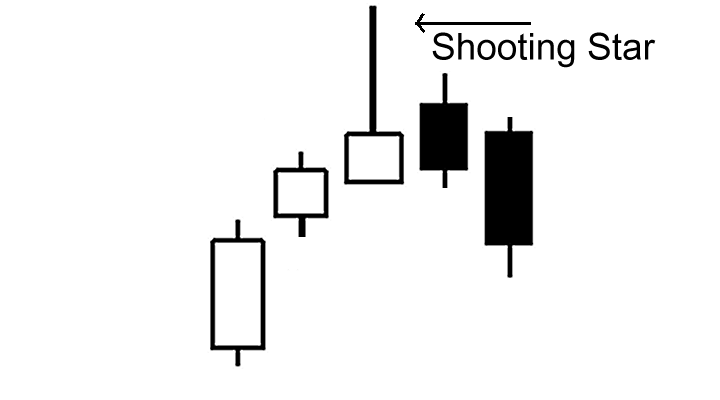

Well, the doji also presents itself after four black crows (I know the candles are red) You want to buy the break of the last red candle with a stop below the doji Your profit target is the most recent high, which will give you a 3 to 1 risk reward ratio CheckUnderstanding candlestick patterns can be very beneficial to see a change in trend or typical price action that supports a move in the direction of the main trend Above, the period from February 26 to March 2 is a great example of seeing a bullish signal on a candlestick chart The wick, or shadow, that indicates the intraday high and low The colour, which reveals the direction of market movement – a green (or white) body indicates a price increase, while a red (or black) body shows a price decrease Find out more about the basics of what a candlestick

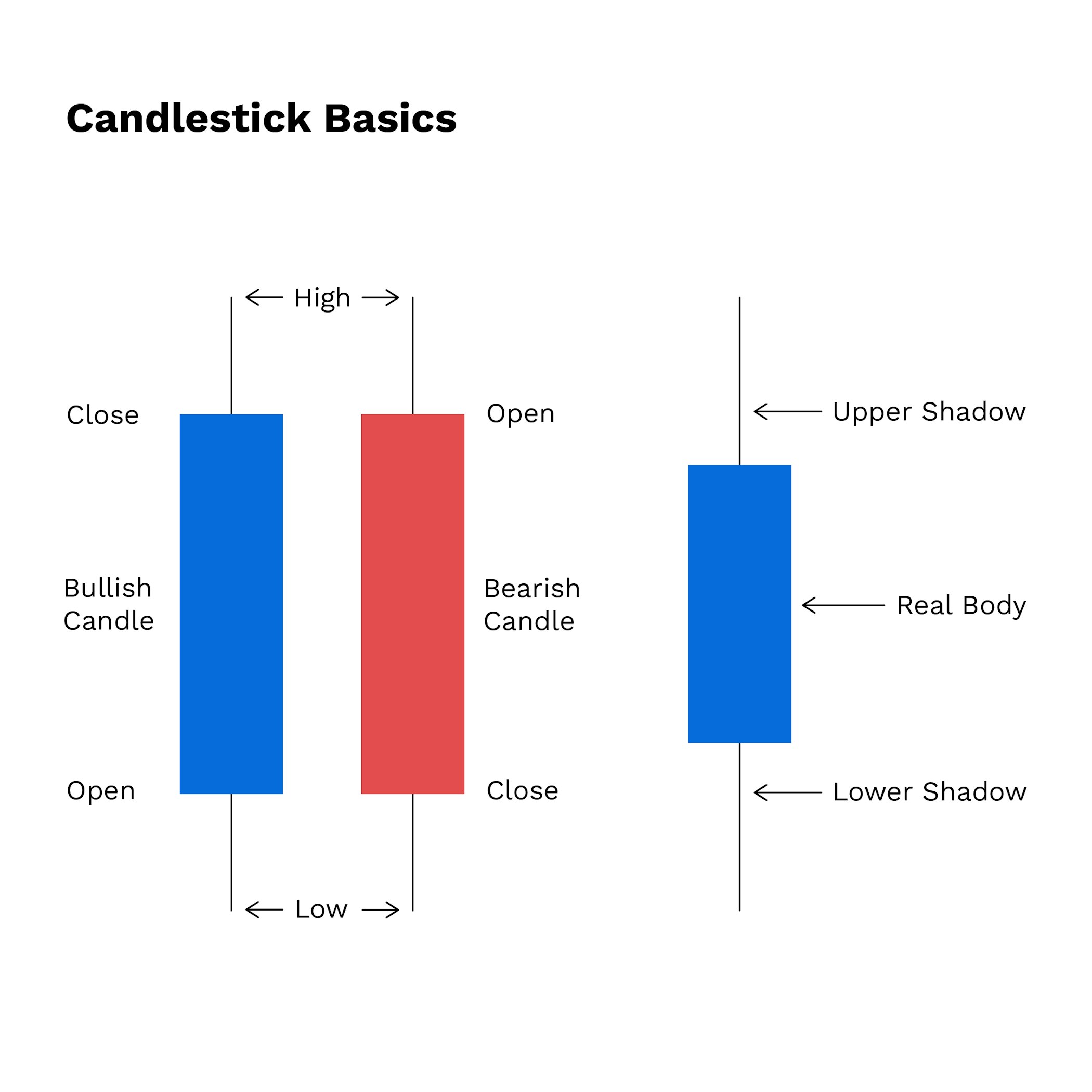

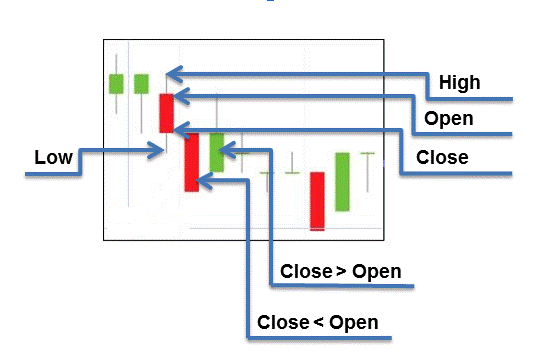

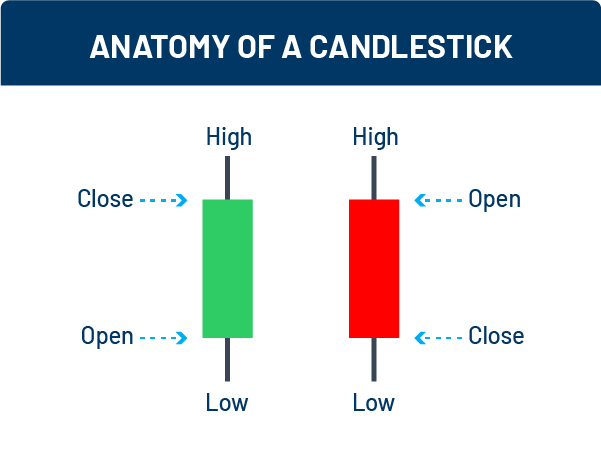

Traditionally, candlestick analysis is used to identify shortterm purchase and sale signals By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors Thus, one can also predict whether stock prices are going to go up or down for the next few days Forex candlesticks explained There are three specific points that create a candlestick, the open, the close, and the wicks The candle will turnYou have a website ready, reliable suppliers on hand and the most important thing, deliciously scented candles waiting to be sold – but you've still got one more thing to do And

Candlestick Charts For Day Trading How To Read Candles

/hammercandlestick-5c620b2ac9e77c0001566ce8.jpg)

Hammer Candlestick Definition And Tactics

The onus is on the seller of the candle to ensure that the candles have been manufactured to meet the required standards and are labeled correctly More information about the laws for selling candles in the US and general candle safety can be foundThe shadows tell you the high and low that price reached during the candle's formation Here are some tips for interpreting binary options candlesticks If you see a long candlestick, that indicates that the buying or selling pressure was strong Price successfully has moved a The Master candle is a concept known to most price action traders The Master candle is defined by a pip candlestick that engulfs the next four candlesticks The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid

Guide To Paham Saham Series Analysis When To Buy And Sell Candlestick Can Tell Shopee Malaysia

Best Candlestick Chart Pattern Pdf Guide 21

There are various factors to consider when starting your own candle business, such as deciding who you're planning on selling candles to, what the candles look and smell like, and most importantly where you plan to sell them Here are four steps to explore prior to selling candles online Audience demographic If you decide to make a candle business, it's important toHow to read a candlestick; Examples of Bullish Engulffing It indicates that the demand for buying is increased so after a downtrend you can take it as trend reversal 9 Bearish Engulfing Candlestick Patterns In this pattern, the real body (open to close) of a bullish candlestick is encompassed by the body of next bearish candle

Candlestick Basics All The Patterns To Master Before Your Next Trade Commodity Com

Everything You Need To Know About Forex Candlestick Patterns Admirals

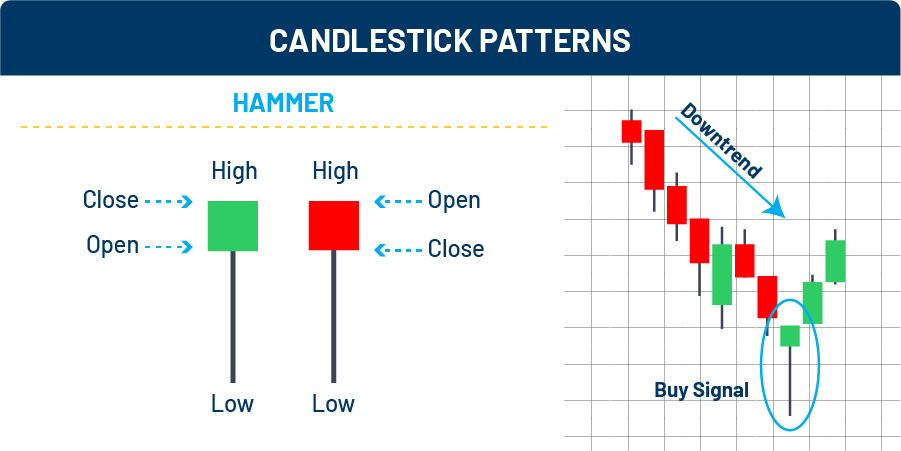

A black or filled candlestick means the closing price for the period was less than the opening price;The conventional shortsell triggers form when the low of the engulfing candle is breached and stops can be placed above the high of the harami candlestick Hanging Man Candlestick A hanging man candlestick looks identical to a hammer candlestick but forms at the peak of an uptrend, rather than a bottom of a downtrend 1 Completely remove SL values from your code Just leave SL to be zero, it is like the SL has been removed from the code 2 Convert TP values from points to pips A point value depends on the user's broker digits For a 4digit broker, 1 point = 1 pip for EURUSD, for a 5digit broker, 1 point = 01 pips for EURUSD, and for a 6digit borker, 1

Trading Candlestick Chart Buy And Sell Buttons On Laptop Screen Forex Trade Flat Vector Illustration Cryptocurrency And Canstock

Price Action How To Predict Next Candlestick Movement Next Candlestick Psychology Patterns Youtube

A comprehensive guide on selling your homemade candles to abide with UK regulationsYou love making candles and wax melts and all things craft and now you want to start selling them? This usually signals that the next candlestick could be a green one 3 Inverted Hammer This is similar to the previous pattern, except that the upper wick is the one that is long It is taken to indicate that although there has been buying pressure, sellers did try to take over but failed to drive the price down A candlestick is said to be bullish if the close price is higher than the open price As a trader, you can choose any color you want to represent a bullish candlestick, but white or green is normally used to indicate a bullish direction

Candlestick Patterns With A Moving Average

How To Trade With The Spinning Top Candlestick Ig En

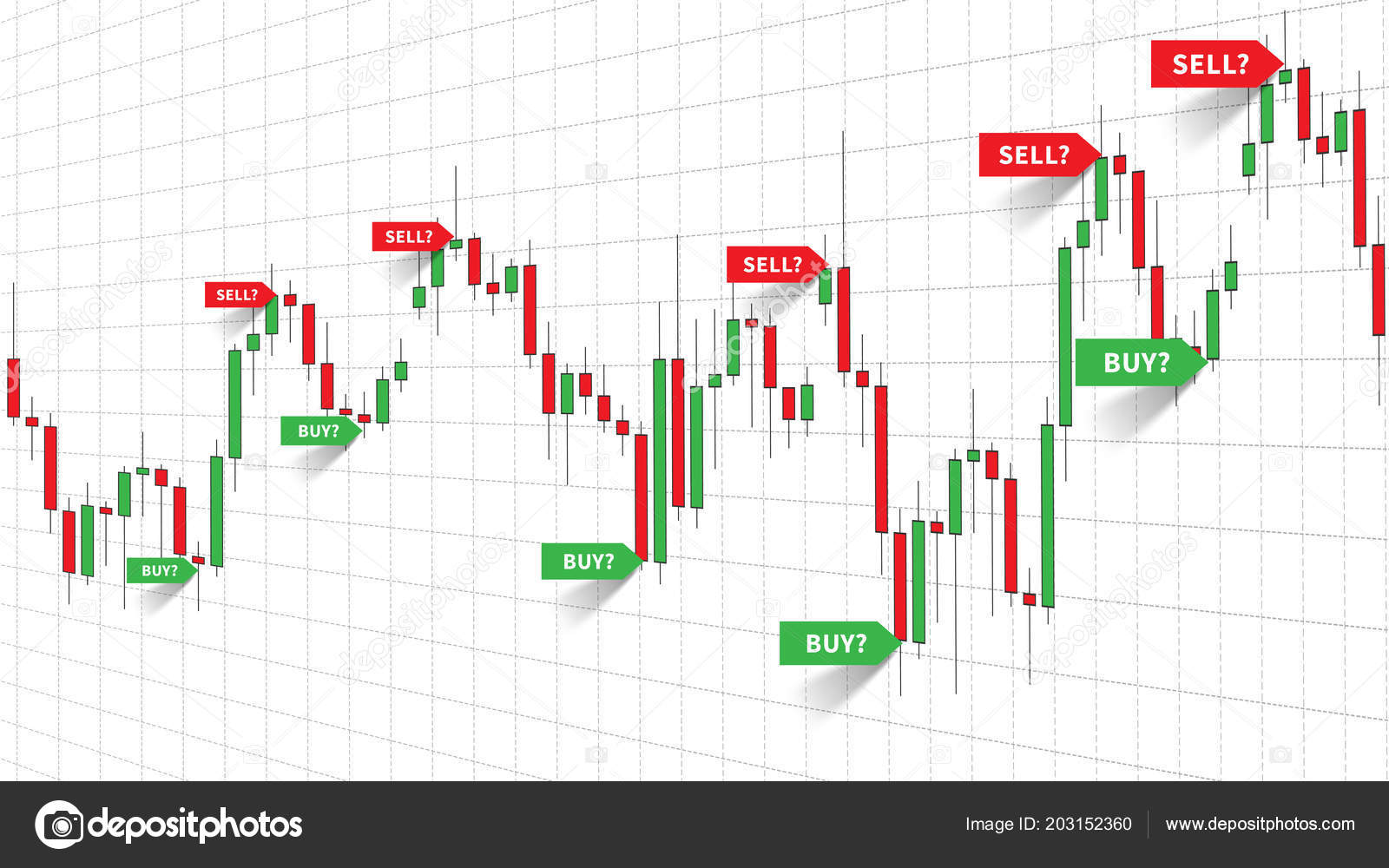

Reading candlesticks Candlesticks can be used to predict the price of a currency pair By reading bars carefully, you can ultimately decide whether it is wise to buy (long) or sell (short) a currency pair In this article, we'll discuss how to use candlesticks We also show the most used & most popular candlestick patternsवेलकम टू स्पीड अर्निंग कॉम / स्पीड अर्निंग इन आज इस वीडियो में आखिर तक आप येBagikan informasi tentang when To BUY And SELL Candlestick Can TELL kepada teman atau kerabat Anda Deskripsi when To BUY And SELL Candlestick Can TELL Deskripsi

Best Candlestick Pdf Guide Banker S Favorite Fx Pattern

Big Story How To Use Candlestick Charts To Predict Stock Price The Hindu Businessline

Hence, it is bearish and indicates selling pressure Meanwhile, a white or hollow candlestickWhen the technical price chart is presenting a downtrend then I prefer to trade stocks with bearish candlestick charts Identify conditions for stocks buying You can use very simple candlestick charts with volume and moving averages Shares which you should accept for a possible bullish trade must have bullish technical charts The Marubozu candle is a momentum candle with either a small, or no, tail This type of candlestick pattern is really powerful and means a lot in regard to price movement Marubozu defines a strong selling off resistance or a strong buying off support Marubozu means 'bald head' or 'shaved head' in Japanese

Price Action How To Predict Next Candle Direction How To Know Next Candlestick Prediction Youtube

Learn How To Read Tweezer Top Bottom Candlestick Charts With This Useful How To Commodity Com

Sometimes a solid candle can be formed when the open was the low and the close was the high, and thin candles with less of a solid body can be formed when a price is volatile and ranges a lot within the day Candlesticks can also give clues to price action and the mood of the market towards a certain stock or index The color, which reveals the direction of market movement – a green (or white) body indicates a price increase, while a red (or black) body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levelsAnswered 3 years ago Sell at a major or minor resistance when you see the shooting star, doji, bearish engulfing, any other confirmation or combinations Buy at major or minor support zones Either support at horizontals, support on trendlines, both, fibonacci levels or other confirmations or combinations

Mastering And Understanding Candlesticks Patterns

How To Read A Candlestick Chart

CANDLES TELL YOU who is in control but do not tell you about the strength of buyer or sellers behind the move, candle with volume shows that The Open Open price tells us where the balance between buyers and sellers at the opening of that period, the 4 Metal, glass, or ceramic containers You can use any glassware that can withstand heat as the mold to make candles at home If you are just trying, you can even use a coffee mug for this purpose However, if you plan to sell candles, it's worth investing in buying a mold to make candlesMy favorite bookshttps//amznto/3dfNvNehttps//amznto/3gXpYCYhttps//amznto/35T56GzPlatform/Broker link for desktop or laptop, click herehttps//bitly/3g

Basic Candlestick Patterns Trendy Stock Charts

Candlestick Charts For Day Trading How To Read Candles

The 5 characteristics of candlesticks;The advantages of this one minute candlestick strategy is that we can use it in both up and downtrends Let's look at the short sell setup for scalping this strategy in down trends Sell Short Setup Scalping Rules 1 A doji with its low below the exponential moving average 8 (EMA8)Hollow candlesticks are simply telling you that there is pressure to buy this trade, hence the movement up in price Whereas filled candlesticks are showing us pressure to sell and a decline in price because of this The length of the body also instructs us of the intensity of the buying/selling

Tutorial 16 A Strategy Based On Candlestick Patterns And Stochastic Crossovers

Candlestick Charts For Day Trading How To Read Candles

Reading candlestick charts is an effective way to study the emotions of other traders and to interpret price Candles provide a trader with a picture of human emotions that are used to make buy and sell decisions On a piece of paper, write down the following statement with a big black marker There is nothing on a chart that matters more than There are many things we can learn from the inner workings of the price action and the candlestick chart and whilst most traders are simply just looking for one, two or even three candle pattern formations, candlesticks and price action can tellThe bullish abandoned baby reversal pattern appears at the low of a downtrend, after a series of black candles print lower lows The market gaps lower on the next bar, but fresh sellers fail to

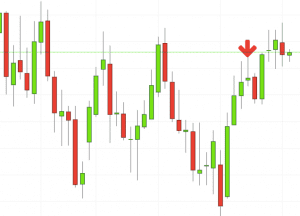

Japanese Candlestick Chart Showing When To Buy Or Sell Tradefromhome

A Guide To Identifying Candlestick Patterns With Examples My Trading Skills

It's also great when you have a favorite candle that you find yourself rebuying, over and over By shopping online you can quickly reorder when your candles are about to burn out Reason 2 Deal Shopping Another bonus that comes with going the online route is that you can compare prices much easier than in brick and mortar stores 4 Buy Supplies from Wholesaler Candles can be made from a wide variety of source materials, so naturally prices vary Subject to the sort of waxes and oils used in their production, it has an impact on your cost But usually, there is a healthy margin for every candle you make For example, soy and palm waxes are more expensive than paraffinTapers are usually thinner at the top than the bottom Sizes range from ½inch to 1inch in diameter and from 6 to 18inches tall Votives Shorter candles (usually between 2 and 3inches tall), that are wider than tapers, but narrower than pillars (between 1 and 2 inches wide) Tea Lights These are the short, discshaped candles that go in

What Are Candlesticks In Cryptocurrency Trading Bitpanda Academy

Candlestick Patterns What Are They How Do You Use Them

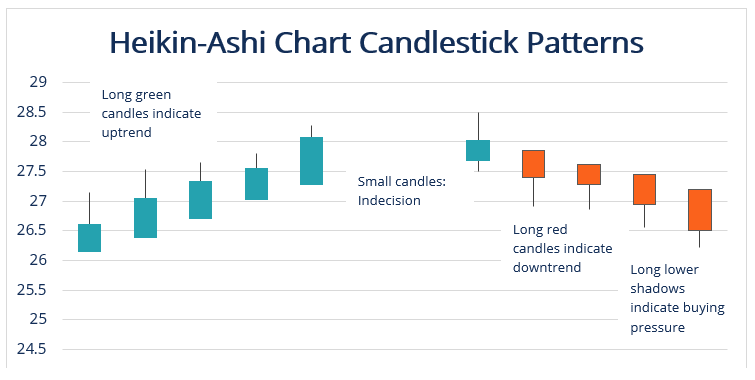

In other words, if a sell signal is given, traders who wait for confirmation, would take the trade on the third day, after the signal was created (day one), only if the day following the signal (day two), the instrument in question, closed below the signal day's lowWhen to BUY and Sell Candlestick can TELL by Santo Vibby 396 Rating details 91 ratings 10 reviews Buku ini merupakan pedoman yang tidak diragukan lagi akan menjadi referensi analisa teknikal untuk dijadikan acuan, bahkan dalam tahuntahun kedepannya dalam transaksi saham di The fifth candlestick in figure 10 shows such an indecision On one hand, this pattern can indicate uncertainty, but it can also highlight a balance between the market players The buyers have tried to move the price up, while the sellers have pushed the price down

Candlestick Analysis Trend Analysis Indicators And Signals Tradingview

What Is A Candlestick And How To Read Candlestick Charts

Forex candlesticks help them guess where the price will go and they buy or sell currency pairs based on what the pattern is telling them Therefore, you should also spare the time to examine the best candlestick patterns for intraday trading if you want to be a

When Do I Buy Sell On A Candlestick Analysis When Trading Forex Quora

Forex Stock Trading Candle Stick Patterns Vector Collection Buy This Stock Vector And Explore Simila Stock Trading Forex Trading Quotes Candle Stick Patterns

16 Candlestick Patterns Every Trader Should Know Ig Us

How To Read Candlestick Charts Warrior Trading

/The5MostPowerfulCandlestickPatterns1-30019e515b6a4ed485b04ab2cfe26157.png)

Candlestick Patterns The 5 Most Powerful Charts

What Is A Candlestick And How To Read Candlestick Charts

1

Red And Green Candlestick Chart With Marked Buy And Sell Positions Royalty Free Cliparts Vectors And Stock Illustration Image

A Beginner Crypto Trader S Guide To Reading Candlestick Patterns

Candlestick Patterns With A Moving Average

Forex Candlesticks A Complete Guide For Forex Traders

Single Candlestick Patterns Part 1 Varsity By Zerodha

Heikin Ashi Technique Overview Formula Chart Strategies

How To Read Candlestick Charts For Intraday Trading

Forex Trade Signals Vector Illustration Buy Sell Signals Indices Forex Vector Image By C Aleksorel Vector Stock

Read Candlesticks Signals Quantified With Buy And Sell Confirmations Online By P Paul Matthews Books

/AdvancedCandlestickPatterns1-f78d8e7eec924f638fcf49fab1fc90df.png)

Advanced Candlestick Patterns

Financial Trade Buy And Sell Signals Vector Illustration Stock Vector Illustration Of Money Internet

How To Make Money With Crypto Candlesticks

Candlesticks

5 Bullish Candlestick Patterns Every Bitcoin Crypto Trader Must Know

4 Best Candlestick Patterns For 21 Stocktrader Com

One Minute Candlestick Trading Strategy

/business-candle-stick-graph-chart-of-stock-market-investment-trading--trend-of-graph--vector-illustration-1144280910-5a77a51937c94f799e7ba6ed23725749.jpg)

How To Read A Candlestick Chart

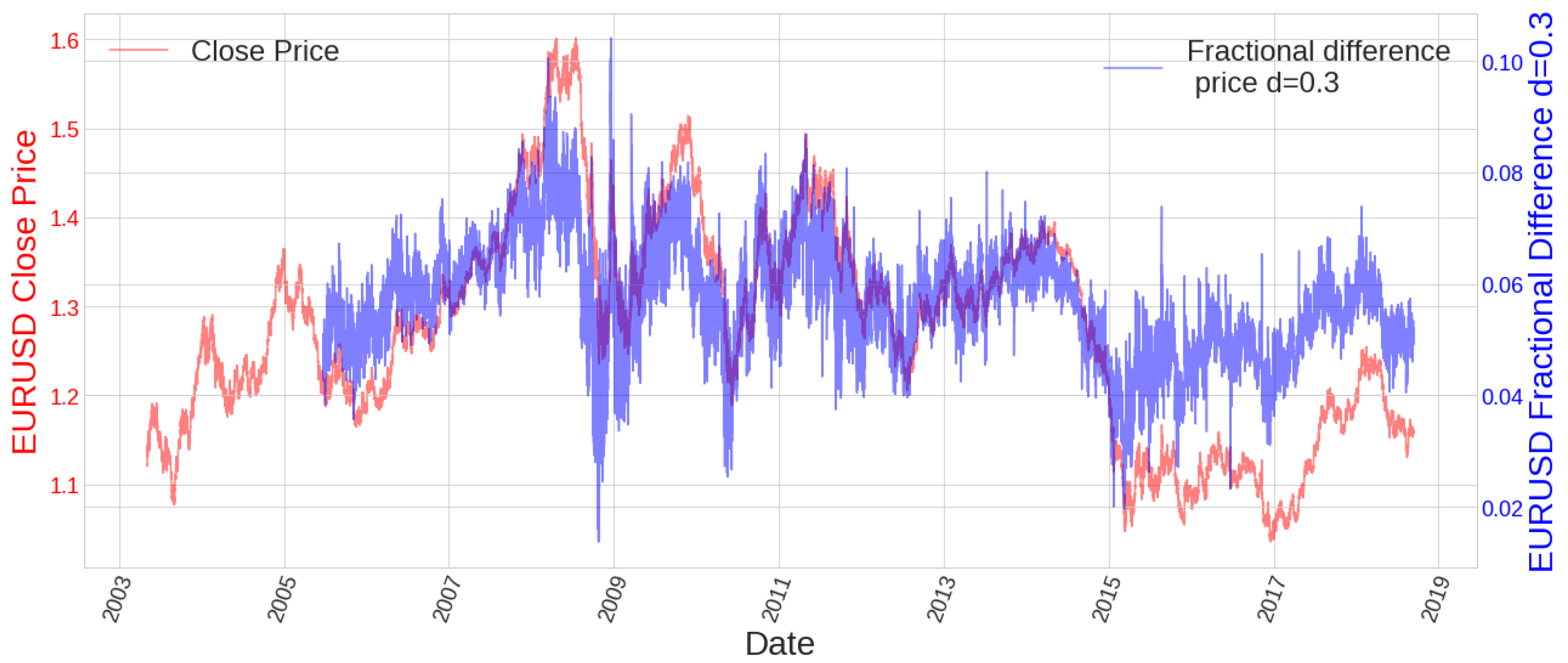

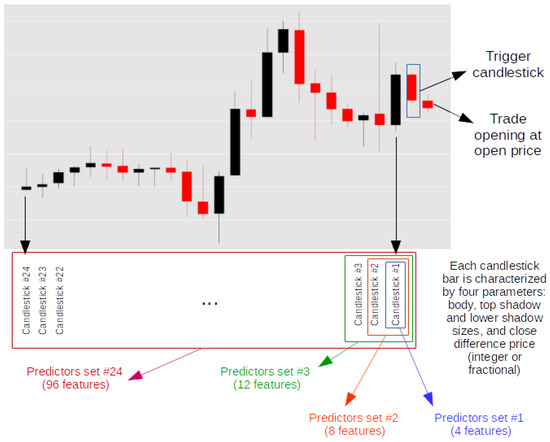

Mathematics Free Full Text Predictive Power Of Adaptive Candlestick Patterns In Forex Market Eurusd Case Html

How To Read A Candlestick Chart

A Guide To Identifying Candlestick Patterns With Examples My Trading Skills

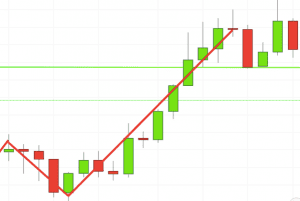

Trading Strategy With Support Resistance Where To Buy Sell And Set Stops Youtube

How To Buy And Sell Stocks In Intraday Using The Candlestick Pattern Quora

How To Read Candlestick Charts For Intraday Trading

Doji Candlestick Formation Forex Com

16 Candlestick Patterns Every Trader Should Know Ig Us

Forex Trading Signals Vector Illustration Buy And Sell Indicators Royalty Free Cliparts Vectors And Stock Illustration Image

Using Bullish Candlestick Patterns To Buy Stocks

Candlestick Patterns With A Moving Average

How To Read Candlestick Charts Warrior Trading

Best Candlestick Pdf Guide Banker S Favorite Fx Pattern

16 Candlestick Patterns Every Trader Should Know Ig Us

Mastering And Understanding Candlesticks Patterns

/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

Using Bullish Candlestick Patterns To Buy Stocks

Volume Candlesticks See How To Trade With This Powerful Indicator

4 Best Candlestick Patterns For 21 Stocktrader Com

Candlestick Patterns You Need To Know With Examples

Reading Candlesticks For Trading This Is What You Ve Been Doing Wrong By Ali Soleymani Medium

Japanese Candlestick Overview How It Works And Patterns

Candlestick Corner When To Sell Candlesticks Tell Working Money

Japanese Candlestick Trading Strategy

Types Of Candles On A Candlestick Chart Stock Trading

Reading And Using Your Candlestick Chart To Make Decisions About Stocks Dummies

Candlesticks With Support And Resistance Babypips Com

3

1

The Truth About Trading Daily Timeframe Nobody Tells You

Best Candlestick Pdf Guide Banker S Favorite Fx Pattern

Candlestick Charts For Day Trading How To Read Candles

How To Read Crypto Charts And Candles The Noobies Guide

When Do I Buy Sell On A Candlestick Analysis When Trading Forex Quora

Patterns For Day Trading Best Chart And Candlestick Signals For Trades

Mathematics Free Full Text Predictive Power Of Adaptive Candlestick Patterns In Forex Market Eurusd Case Html

Patterns For Day Trading Best Chart And Candlestick Signals For Trades

Mastering And Understanding Candlesticks Patterns

Types Of Candles On A Candlestick Chart Stock Trading

Forex Buy And Sell Signals Simple Profitable Daily Price Action

Japanese Candlestick Trading Strategy

Candlestick Patterns That Lead To Buy And Sell Signals Candlestick Patterns Forex Trading Tips Intraday Trading

Business Candlestick Chart Buy And Sell Buttons Vector Image

Candlesticks With Support And Resistance Babypips Com

How To Make Money With Crypto Candlesticks

Candlestick Charts For Day Trading How To Read Candles

Candlestick Chart Patterns Basic Introduction Price Action Trading Strategies Youtube

Forex Trade Signals Vector Illustration Stock Vector Illustration Of Candlestick Marker 146

Patterns For Day Trading Best Chart And Candlestick Signals For Trades

Find Buy And Sell Opportunities By Candlesticks China Investtech

Find Buy And Sell Opportunities By Candlesticks China Investtech

:max_bytes(150000):strip_icc()/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

Using Bullish Candlestick Patterns To Buy Stocks

1

How To Make Money With Crypto Candlesticks

Candlestick Charts For Day Trading How To Read Candles

0 件のコメント:

コメントを投稿